Benefits

-

You can create goals for each of your savings accounts.

-

Use the Rainy Day Savings Planner to find out how much to save for an emergency fund.

-

Track your progress against each savings goal in the ASB Mobile app.

-

Keep motivated by personalising your savings account name and image.

How Goal Planner works

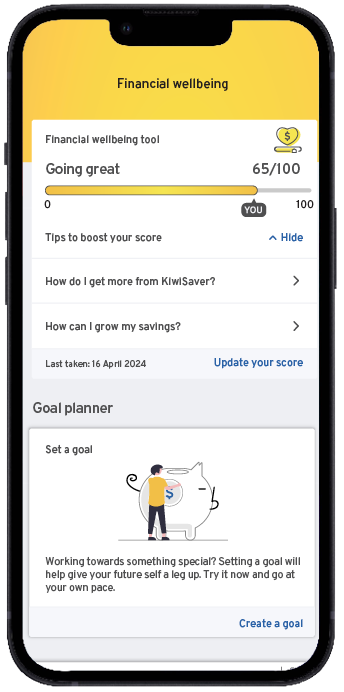

Goal Planner is a tool for our customers to set and track their money goals through the ASB Mobile app. You can access Goal Planner in the Financial Wellbeing Hub and create goals for each savings account. In the app you'll be able to quickly see how you're tracking towards your goal, either on your account screen or in the Financial Wellbeing Hub.

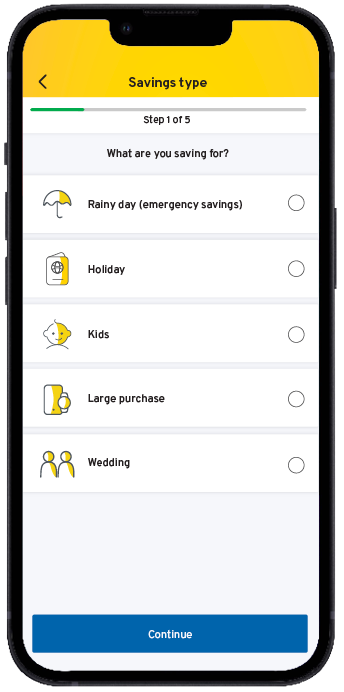

To help you start reaching your savings goals, we've created a few handy goal types to get you planning. Whether you're saving for a holiday or your first car, setting your savings goal is the first step to achieving it.

Get started

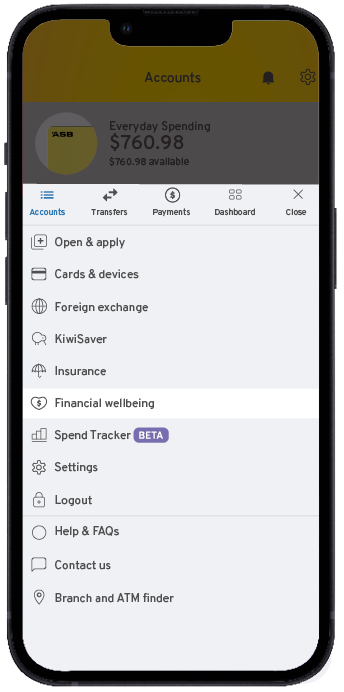

1. Log in to the ASB Mobile app and tap 'More' in the bottom right hand corner. Then click 'Financial wellbeing'.

2. Scroll down to Goal planner and click 'Create a goal'.

3. Select what you are saving for and follow the prompts on screen.

Rainy Day Savings Planner

When setting a savings goal to help cover those unexpected expenses, you can use our Rainy Day Savings Planner located within Goal Planner. This clever tool will help you work out how much you should aim to save, based on your situation.

Simply start setting up a rainy day (emergency savings) goal and follow the steps to calculate an amount to save. You'll need a few details like your current expenses and income, then we'll suggest what your emergency fund should be.

Questions you might have

How is the 'Still need to save' figure calculated?

Can I update my savings goal once it's achieved?

What else can you do in the ASB Mobile Banking app?

Check your financial wellbeing

Discover your financial wellbeing score, set savings goals, and find tips and tools to help you make smart money choices. Find out more here.

Save money without even thinking about it

Save as you spend with Save the Change. We automatically round up your electronic transactions and put the difference into a savings account you choose. You can also choose to donate your change, in addition to saving it.

Keep track

Track your ASB Visa card subscriptions in one place and see the shops and services where your card details may have been stored. Learn more about Card Tracker here.

See where your money is going

See where your money is going with Spend Tracker. It automatically categorises your transactions and is a great way to see a monthly view and trends in your spending.

We're Canstar's Bank of the year for Digital Banking for three years running

Canstar has awarded ASB for delivering our customers the best in digital banking through our mobile app and internet banking.